The Role of Surety Bonds in Trucking

Surety bonds are important financial tools used in many industries, including trucking.

They help ensure that companies follow regulations and provide financial protection for both businesses and consumers. In the trucking industry, where moving goods is key to keeping commerce running, a surety bond acts as a promise that companies will meet legal requirements and perform their duties as expected.

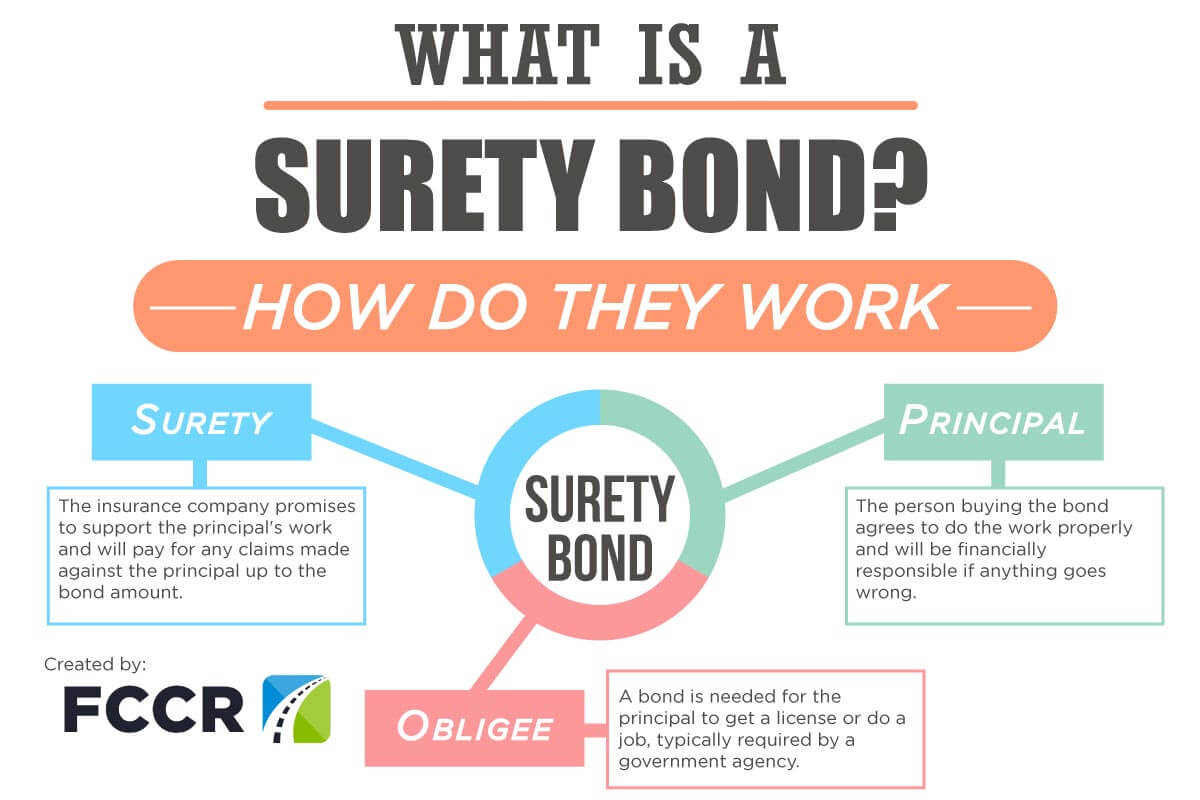

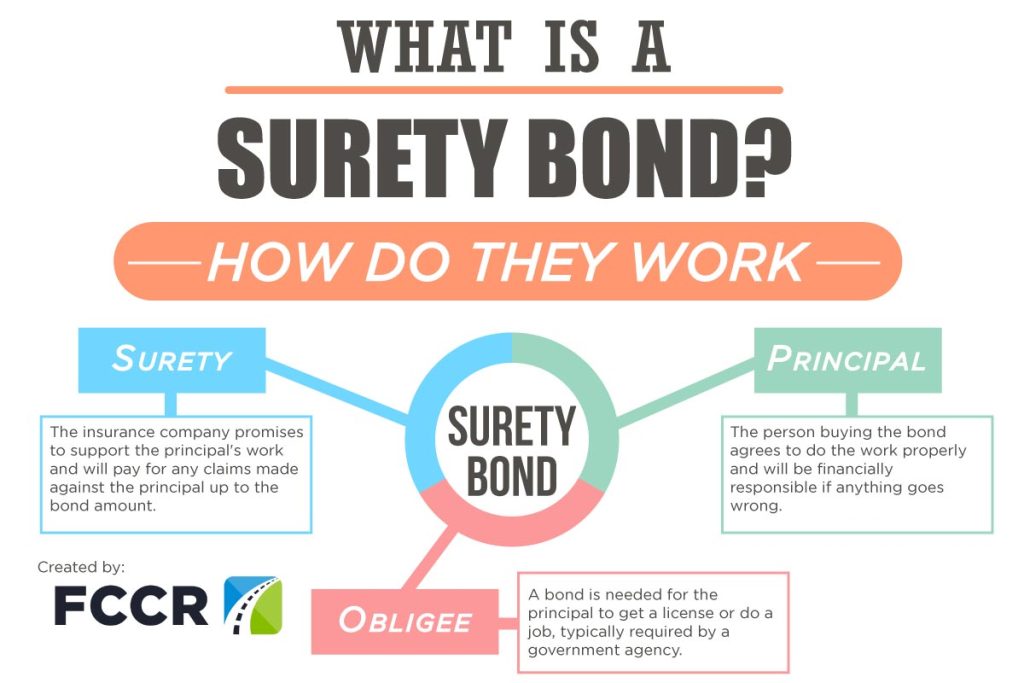

What is a Surety Bond?

A surety bond is an agreement between three parties: the principal (the one who needs the bond), the obligee (the one asking for the bond), and the surety (the company providing the financial guarantee). The bond guarantees that if the principal doesn’t meet their obligations, the surety will pay the obligee a set amount of money.

Types of Surety Bonds in the Trucking Industry

In the trucking industry, several types of surety bonds are common:

Freight Broker Bonds (BMC-84): Required by the Federal Motor Carrier Safety Administration (FMCSA) for freight brokers and forwarders. This bond ensures that brokers follow regulations and meet their financial responsibilities to carriers and shippers.

Motor Carrier (MC) Authority Bonds (BMC-85): Motor carriers moving goods across state lines need this bond as part of their application for operating authority. It guarantees that carriers will follow federal rules and cover any damages or liabilities from transporting goods.

ICC Broker Bonds: Before the trucking industry was deregulated, interstate carriers needed an Interstate Commerce Commission (ICC) broker bond. Even though the ICC no longer exists, some states still require these bonds for licensing.

Role of Surety Bonds in the Trucking Industry

Surety bonds serve several key purposes in trucking:

Compliance: Regulatory agencies like the FMCSA require surety bonds to ensure trucking companies follow federal regulations. Having a bond shows that a trucking company is committed to meeting industry standards and protecting consumers.

Financial Protection: Surety bonds offer a safety net for those harmed by a trucking company’s actions or negligence. If a company doesn’t meet its obligations, the harmed party can file a claim against the bond to recover financial losses, such as unpaid freight charges or damages from lost or damaged cargo.

Risk Management: They reduce financial risks in the trucking industry. By requiring bonds, regulatory authorities hold carriers, brokers, and freight forwarders accountable, encouraging responsible behavior.

Consumer Confidence: They also help build trust in the trucking industry. They ensure that companies are vetted and financially capable of doing their jobs well. This trust is crucial because reliable and timely movement of goods is vital for keeping supply chains running smoothly.

Related Articles: